The Medicare Donut Hole Explained

In simple terms, the Part D Coverage Gap, also known as the Medicare donut hole, is a temporary ceiling on drug coverage benefits where the beneficiary is responsible for his or her prescription costs until reaching a certain out-of-pocket threshold. At this point, insurance coverage will kick back in to cover drug costs.

Understanding Medicare Part D Prescription Plans

Before attempting to understand the Medicare donut hole, you should understand how Medicare Part D plans work. Medicare insurance coverage for prescriptions is offered through private health insurance companies. You can enroll in a Part D plan if you have Original Medicare, by selecting a Medicare Advantage plan that includes drug coverage (also called a Medicare Advantage and Prescription Drug plan), or by enrolling in a drug plan if your Medicare Advantage plan does not include drug coverage. Regardless of how you obtain your Part D coverage, you will likely pay a monthly premium for your insurance plan.

Each Part D plan comes with an annual deductible (which Medicare sets a maximum cost for each year), and insurance providers will not cover the cost of your medications until you pay this deductible amount out of pocket. Once you have paid 100% of your deductible, prescription insurance kicks in to defer some of the cost. From that point forward, you will pay a portion of your prescription costs (often up to 25%) while the insurance provider handles the remainder.

Where the Donut Hole Appears

Many people simply never face the Medicare donut hole because their medication needs are limited or their prescription drug costs are low.

After paying a monthly premium and annual deductible, most people will pay small out-of-pocket costs to receive the medications they need. However, individuals who require numerous or costly prescriptions, especially for debilitating or chronic illnesses, they may quickly reach a temporary cap on the amount of money their insurance plan is willing to pay for their medications.

This is the donut hole, or coverage gap. Beginning in 2019, those with Part D benefits will pay 25% of the cost of the prescriptions from when they enter the coverage gap through the point of catastrophic coverage.

The donut hole has slowing been closing since the passage of the affordable care act in 2010.

What Happens When You Enter the Donut Hole

If you and your insurance plan have chipped in a total of $3,310 for your prescription medication costs and you still have months in the year to go, you have entered the donut hole. Unfortunately, people in this gap are responsible for the full costs of prescription drugs until reaching their yearly out-of-pocket spending limit. In 2018, that cap was $3,750, meaning that until you have spent this amount out-of-pocket on medications, you are responsible for their cost.

After reaching this point, you are out of the donut hole and will receive some coverage once again from your insurance provider.

Fortunately, there are ways to help you get through the gap faster. Even if you are left to cover the entire cost of your medications, you will only pay 25% (in 2019) of your insurance plan’s cost for any brand name prescriptions.

This discount is automatically applied when you purchase prescription drugs through a brick-and-mortar or mail-order pharmacy. Despite paying less than half the cost, you’ll get credit for 95% of the drug’s cost, which will help you move through the gap faster and keep costs somewhat limited. Dispensing fees and your insurance provider’s contribution to that refill do not count towards your out-of-pocket spending. The process is similar for generic medications, though you’ll pay 63% of the medication cost and Medicare will pay the remaining 37%. Unfortunately, you can only count the actual amount you paid towards your out-of-pocket cost.

What Happens After You Leave the Coverage Gap

After you’ve made it through the Part D donut hole, your insurance plan will once again begin paying some or most of the cost of your medications. Unfortunately, you likely will still be responsible for a small portion of your medication despite reaching your yearly spending limit. In some cases, it’s as small as 5% of your prescription cost. Medicare calls this “catastrophic coverage.”

Does Every Part D Plan Have a Donut Hole?

Because there’s a wide variety of plans meant to meet different needs, it’s hard to say for certain if every plan has a donut hole. If you feel that medication costs are unaffordable, especially on expensive brand name drugs or with frequent use, it’s important to determine if your plan has this gap.

Connect with a Medicare Specialist at PolicyZip to discuss your specific needs. Call us at (844) 205-7510 or fill out the form below.

How Will I Know If I’m Close to the Medicare Gap?

If you’re unsure about how much you and your insurance company have put towards your medications, be sure to read the “Explanation of Benefits” that insurance companies send along with a prescription or after you have filled a medication. This document will explain your recent insurance costs alongside your year-to-date spending. It will also inform you about how close you are to the coverage gap or if you’ve reached it.

Combating the Donut Hole

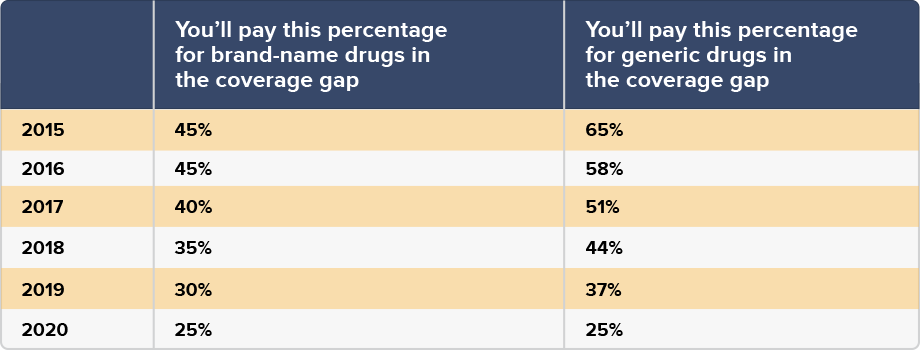

The Affordable Care Act is working to lessen and eventually close the Part D coverage gap, with plans to have it completely gone by 2020. In the meantime, regulations have ensured that you’ll pay less and less each year you enter the donut hole. That means you will pay a smaller percentage of the total drug cost for both brand name and generic drugs while you work your way through the gap, and you will still receive credit for most of the amount for brand name medications.

However, that may be of little relief if you’re stuck in the coverage gap before 2020. In situations where you cannot afford the cost of medications, even with help from your Part D plan, programs like Extra Help can pay some or most of the cost. If you’re already an Extra Help recipient, there is no need to worry about entering the gap at all because your out-of-pocket costs will be minimal.