What You Need to Know About Your Medicare Card

A brief introduction to what you need to know about your new Medicare card.

First, let’s make sure you understand the basics of Medicare.

What is Medicare?

Medicare is a health insurance program administered by the federal government. It provides coverage for those who are 65 and older, as well as for some people with qualifying illnesses who are younger than 65.

Medicare has four parts:

Part A is hospital insurance that covers medically necessary inpatient hospital care, long-term care, skilled nursing facility care, hospice, and home health care.

Part B covers doctors’ services or supplies that are needed to diagnose and treat a medical condition, durable medical equipment (i.e. wheelchairs). It also covers preventative care services to detect or treat illnesses at an early stage when treatment is most likely to work the best, outpatient services, lab tests and x-rays, ambulance services and some home health services. You can go here to see what specific tests are covered.

Part C allows private health insurance companies to provide Medicare benefits to patients. This includes providers such as HMOs and PPOs. They are known as Medicare Advantage Plans. Some people choose to get coverage through a Medicare Advantage Plan instead of through original Medicare coverage because additional services are provided that may not be covered through Part A or Part B Medicare.

Part D provides prescription drug coverage. It is provided only through private insurance companies that have contracts with the government and adds drug coverage to Original Medicare for an additional premium payment.

Am I eligible to receive a Medicare card?

There are two primary groups that are eligible to receive a Medicare card.

People 65 years and older who are citizens or permanent residents are eligible if they meet the following criteria:

- You currently receive Social Security benefits. To be eligible to receive Part A at no cost, you must have accumulated 40 credits through the payment of payroll taxes. If a person meets minimum income guidelines, they will earn 1 credit for each quarter they work, meaning 40 work credits equals 10 years of work history. If a person does not have 40 credits, they can still be covered under Part A by paying a monthly premium.

- You receive, or are eligible to receive, railroad retirement benefits, or your spouse receives or is eligible to receive railroad retirement benefits or Social Security benefits. This applies to spouses who are living, divorced or deceased from the person seeking Medicare coverage.

- You or your spouse worked long enough in a government job where Medicare taxes were paid.

People under 65 years old with qualifying medical conditions are eligible for no cost Part A coverage if they meet the following criteria:

- You receive, or you are entitled to receive, Social Security disability benefits for 24 months.

- You are getting a railroad retirement board disability pension and you meet certain conditions.

- You get Social Security disability benefits because you have ALS, (amyotrophic lateral sclerosis, aka Lou Gehrig’s disease).

- You worked in a government job long enough where you paid Medicare taxes, and you have been entitled to receive Social Security disability benefits for at least 24 months.

- You have kidney failure and you receive dialysis or have had a kidney transplant.

- You’re the child or a widow(er) age 50 or older of someone who worked in a government job long enough where they paid Medicare taxes, and you meet Social Security disability program requirements.

Medicare Part B eligibility

If you are eligible for Part A coverage at no cost, you can enroll in Part B coverage by paying a monthly premium. If you are not eligible for Part A at no cost, you can still sign up for Part B if you are 65 years or older and you are a U.S. citizen or a lawfully admitted non-citizen who has lived in the country for a at least of five years.

Medicare Part C eligibility

If you have Part A and Part B coverage, you can join Part C coverage. Part C, also known as Medicare Advantage, offers additional benefits over and above the benefits provided by Part A and Part B coverage. You will pay a premium for this coverage which kicks in once you have reached coverage limits under Medicare Part A and B

Medicare Part D eligibility

If you have Part A and Part B Medicare coverage, then you are eligible for Part D coverage. Part D provides prescription drug coverage. Part D is optional and you will need to pay a monthly premium for coverage.

How to apply for a Medicare card

The annual open Medicare enrollment period begins each year in October, but there are other times during the year that people can apply if they have certain qualifying conditions.

Those who have been receiving Social Security Disability Insurance (SSDI) benefits for at least two years will qualify for Medicare automatically. If you are already getting Social Security or railroad retirement benefits, you will be contacted about three months before you turn 65 years old. If you live in one of the 50 states, Washington, D.C., the Northern Mariana Islands, American Samoa, Guam or the U.S. Virgin Islands, you will automatically be enrolled in Medicare Parts A and B.

If you are not already getting Social Security or railroad retirement benefits, you can

enroll in Medicare during the Initial Coverage Election Period to avoid any penalties or a gap in your health care coverage. The Initial Coverage Election Period is a seven-month period beginning three months before the month you turn 65 and ending three months after your 65th birthday.

There are also special situations that allow you to apply for Medicare before age 65:

- You’re a disabled widow(er) between 50 and 65.

- You work for the government and became disabled before turning 65.

- You or an immediate family have permanent kidney failure.

- You had Medicare Part B coverage in the past but dropped coverage.

- You turned down Medicare Part B coverage when you first got Medicare Part A coverage.

- You or your spouse worked for the railroad industry.

Because there is a premium to be paid for Part B coverage, you will be given the choice of opting out of this coverage when you initially enroll. If you don’t enroll in Medicare Part B during your initial enrollment period, you can still sign up during an annual enrollment period from January 1 through March 31. You will be covered on the following July 1 of the year that you sign up.

Medicare enrollment forms and related information is available online at the Medicare website. You can also visit the nearest Social Security office to get additional information on how to enroll in Medicare.

Should I carry my Medicare card in my purse or wallet?

When you need medical services, your visit will be expedited if you are able to produce your new Medicare card where you are being treated. Just like other forms of insurance, you will be asked for it when you arrive. Only give your Medicare card and information to medical providers such as doctors’ offices, hospitals, pharmacists or other health care providers that you trust. If you do forget your card, a health care provider may be able to look up your Medicare number and information online.

How do I get a replacement Medicare card?

If you lose your Medicare card or you can’t use it any longer because it’s damaged or faded, you can replace it by providing your name, Social Security number and your date of birth to the Social Security Administration. You can do so online by using your “my Social Security” account if you have one (if you don’t, you can also create one). Once you are signed in, go the “Replacement Documents” tab to complete your request.

If you don’t want to use the online service, you can call 1-800-772-1213 (TTY 1-800-325-0778), Monday through Friday, from 7 a.m. to 7 p.m. or you can contact your local Social Security office.

It will take about 30 days to get your new Medicare card in the mail.

Does my Medicare card include prescription drug coverage?

You can get prescription drug coverage if you enroll in Medicare Part D, which is specifically for prescription drug coverage. You can also get drug coverage through a Medicare Advantage Plan (Part C), as long as it is designated as one of the benefits. To get Part C or Part D coverage, you must be enrolled in Part A and Part B. You must also live in the service area of the Medicare plan or drug plan that you want to access. Different drug plans offer different levels of coverage, so be sure to shop around before making a final decision.

Does my Medicare card include dental coverage?

Medicare does not cover the most common dental services such as cleanings, fillings, extractions, dentures, dental plates and other related services. The exception for this is that Medicare Part A will pay for some dental services that you can get if and when you’re in a hospital and you need to have emergency or complicated dental procedures.

If dental coverage is important to you, you might want to consider taking out a Medicare Advantage Plan that covers dental services.

Does my Medicare card include vision coverage?

Medicare Part B covers some vision services, but not routine vision exams. Part B does cover some diagnostic and preventative eye exam services. This may include conditions such as age-related macular degeneration. Part B also covers a glaucoma test once every 12 months for people considered a high risk for glaucoma. To get the best possible vision coverage, you will need to buy a Medicare Advantage Plan that includes vision services.

Where can I use my Medicare card?

You will use your Medicare card at medical providers that accept Medicare as a form of payment for services rendered. When in doubt, check with the doctor or hospital you are considering. If you have Original Medicare, about 96% of all doctors are registered to bill Original Medicare for your healthcare. The few remaining doctors are generally specialists who choose to see patients on a private-pay basis.

Do I get any additional discounts with my Medicare card?

If you get your health insurance through Medicare, you may be eligible for discounts at pharmacies. However, you may need to ask for the discount, because there is a statute that prohibits physicians, pharmacies and healthcare providers from offering giveaways to entice Medicare and Medicaid patients.

Do green card holders over 65 qualify for a Medicare card?

Medicare is available for United States citizens and legal permanent residents (green card holders). If you are a recent green card holder or new immigrant to the US, aged 65 years or older, and never worked in the U.S., you may not immediately qualify for Medicare.

However, if you don’t qualify for free Medicare, you can still purchase it, if:

- You are 65 or older,

- Have recently become a United States citizen by naturalization and haven’t worked enough quarters to have social security coverage, and

- You are a green card holder and have constantly lived in the United States for five years or longer and don’t qualify for the Social Security benefits.

What’s the difference between my Medicare card and my Medicare Advantage card?

Your Medicare card is used to provide services covered under Part A and Part B of Medicare. Use it when you are accessing services that are covered under these terms. Your Medicare Advantage card will be used for enhanced services that are provided over and above what Original Medicare covers. This could be dental, vision or other similar services that are covered, based on the plan you purchased. Be sure to present the right card when you are being treated so that the right program can be billed for services.

Do I use my Medicare card or my Medicare Supplement card at the doctor?

Medicare Supplement insurance, also known as Medigap, helps pay some of the healthcare costs that Medicare does not cover. This includes things such as copayments, deductibles, and coinsurance. To get a Medigap card, you must have Medicare Part A and Part B. You should show this card every time you get services from a hospital, doctor or other medical provider.

What is the difference between a Medicaid card and Medicare card?

Medicaid provides medical insurance for low-income and needy people. It is funded jointly through the federal government and state governments and covers children, those who are blind or disabled, the elderly and others who are eligible to receive assisted income-based payments. It is administered by states according to federal requirements.

What you need to know about new Medicare cards.

Why am I getting a new Medicare card?

In April 2018, The Centers for Medicare & Medicaid Services (CMS) started mailing new Medicare cards to more than 57 million program participants. The changeover began several years ago as part of a fraud and identity theft prevention strategy. New cards will no longer have Social Security numbers on them. Instead the new cards have a random and unique 11-digit callout known as a Medicare Beneficiary Identifier (MBI). It is a combination of numbers and upper-case letters that will serve as a beneficiary’s Health Insurance Claim Number (HICN) instead of the previously used Social Security number.

Implementation of the new cards came about as a direct result of the dramatic increase of personal identity theft crimes on seniors. Incidents among people age 65 or older increased to 2.6 million from 2.1 million between 2012 and 2014, according statistics from the Department of Justice.

Despite increased protection from the new MBI cards, CMS officials have stressed that the new Medicare cards should be treated with the same level of confidentiality as a Social Security number because an MBI is still considered as personally identifiable information.

Will my new Medicare number change my benefits?

No. Benefits will remain the same.

What will change is that the new MBI will replace the HICN for use on several different types of transactions including billing, eligibility status and claim status. The Center for Medicare and Medicaid Services will also use the new MBI to continue conducting business with current benefit providers such as the Social Security Administration, the United States Railroad Retirement Board, State Medicaid agencies, health care providers, and health plans.

Once you receive your new Medicare card with an MBI, you can destroy your old card and begin using your new one immediately.

When can I expect to receive my new Medicare card?

Congress has mandated that the deadline for replacing all Medicare cards must take place by April 2019. There will also be a 21-month transition period that will run through December 31, 2019. Providers will be able to use either the MBI or the HICN.

CMS officials will monitor the transition period to determine how well the adoption of the MBIs is going and may extend the period to make sure that Medicare operations are not disrupted by the changeover.

You don’t need to do anything to get a new Medicare card. Medicare will automatically mail your new card to the address they have on file. If you need to update your address or check to make sure it is current, go here.

The new Medicare cards will be mailed to beneficiaries in waves. Here’s is when you can expect to receive yours:

| Wave | States Included | Cards Mailing |

| 1 | Delaware, District of Columbia, Maryland, Pennsylvania, Virginia, West Virginia |

April – June 2018 |

| 2 | Alaska, American Samoa, California, Guam, Hawaii, Northern Mariana Islands, Oregon |

April – June 2018 |

| 3 | Arkansas, Illinois, Indiana, Iowa, Kansas, Minnesota, Nebraska, North Dakota, Oklahoma, South Dakota, Wisconsin |

After June 2018 |

| 4 | Connecticut, Maine, Massachusetts, New Hampshire, New Jersey, New York, Rhode Island, Vermont |

After June 2018 |

| 5 | Alabama, Florida, Georgia, North Carolina, South Carolina |

After June 2018 |

| 6 | Arizona, Colorado, Idaho, Montana, Nevada, New Mexico, Texas, Utah, Washington, Wyoming |

After June 2018 |

| 7 | Kentucky, Louisiana, Michigan, Mississippi, Missouri, Ohio, Puerto Rico, Tennessee, Virgin Islands |

After June 2018 |

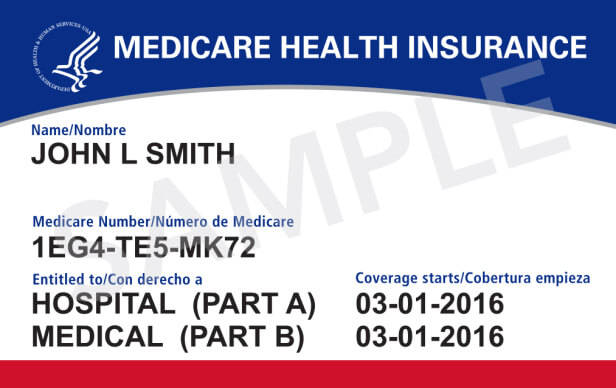

What do the new Medicare cards look like?

Who should I contact for more information about new Medicare cards?

To learn more, call the Medicare toll-free number at 1-800-MEDICARE (1-800-633-4227). If you are hard of hearing or deaf, call Medicare’s TTY number at 1-877-485-2048.