Original Medicare Part A

Understanding and signing up for Medicare can be confusing. The process can feel like healthcare alphabet soup — every different part seems to have its own letter and abbreviation. So what does it all mean and how does it apply to you? If you’re looking to grasp the basics of Medicare, the best place to start is understanding Original Medicare Part A.

What is Original Medicare?

We get this question all the time, what is original Medicare?

Simply put, Medicare is health insurance for those of retirement age or those that are disabled.

Many people have insurance benefits through their employer, and when they retire, those benefits might end. For this reason, original Medicare exists to help you cover the costs of doctor’s appointments, hospital stays, medications and other health needs you may face.

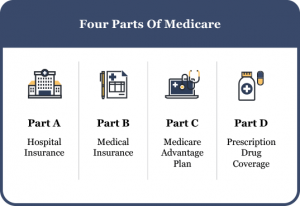

When Medicare was first created in the 1960s, there was really only one “part” to enroll in. This standard coverage stuck around for nearly 20 years, until U.S. citizens began asking for additional options to meet their specific needs. By the 1980s, more choices had become available, and Medicare benefits split off into two branches that we still use today: Original Medicare (which comes in Part A and Part B) and Medicare Advantage (also called Part C).

Who is Original Medicare Part A For?

Nowadays, Original Medicare Part A is the basic coverage you can receive as part of your Social Security benefits following retirement. Original Medicare is also available to help out people who haven’t retired but face some difficult, chronic or potentially terminal health issues, such as ALS (also known as Lou Gehrig’s disease) or End-stage renal disease (kidney failure that can only be treated through dialysis or a transplant). Individuals who are legally disabled are also able to enroll for this kind of health coverage, even if they aren’t retirees.

What Original Medicare Provides

Part A can be summed up as hospital coverage. It primarily covers in-patient services and does not cover outpatient services like doctor’s appointments or preventative care. Some examples of what Original Medicare Part A pays for include:

In-patient care

Part A covers hospital admissions and associated care from doctors, nurses and other staff during a hospital stay. This coverage is intended to protect against financial burdens related to major health situations, such as a heart attack or stroke, that require you to stay in a hospital to receive care. Part A can be used at hospitals that accept Medicare (most hospitals) and critical access hospitals (small medical facilities in rural areas that typically handle outpatient care, but can admit patients if necessary).

Nursing facility care

Many medical providers are considered nursing facilities because they provide services you may need that can’t take place in a hospital. One example of this is a rehabilitation center, where you may need a skilled trainer or nurse to help you with exercises after a disability, illness or major health change such as a stroke. It’s important to know that Part A does not cover nursing home services or other forms of long-term care that go beyond a medically necessary health need (such as a home health aid who also completes errands and chores).

Hospice care

Individauls with terminal diseases or health situations still require care. Hospice care is for terminally ill patients who have no other course of treatment. This is different from in-patient care because it helps make sure that recipients are comfortable, and their physical, social and emotional needs are met nearing the end of their life. In some cases, hospice care is given at home, while other hospice patients receive it at a nursing facility. Hospice can also provide resources and help for a patient’s caregivers and family.

Some home health services

While Part A doesn’t cover many forms of long-term care, it can provide insurance coverage if you have home health care needs. This is the case if a doctor recommends you need certain types of medical supplies or help at home, and often comes with a plan your doctor creates to ensure you get the best care outside of a hospital. Medicare is particular about the kinds of home health care it will cover, and if you need these services, it’s important to check that they qualify first to save yourself headaches and out-of-pocket expenses.

What Part A Will Not Cover

Remember how we said that Part A is the most basic form of Medicare? That means it’s limited in what it will cover (and for that reason, there are other forms of Medicare you can sign up for to help cover your healthcare needs). Because Part A is primarily for hospital needs, there are many things it will not cover, such as:

- Dental care and dentures

- Eye examinations necessary for getting glasses

- Hearing aids or any exams needed to properly fit them

- Routine, non-emergency health care from your doctor

- Specialty services like foot care, acupuncture or chiropractics

These services may be covered by Part B, if deemed medically necessary, but are generally only covered by additional private insurance policies. Connect with a Medicare Specialist at PolicyZip by calling (844) 205-7510 or filling out the form below to discuss these options.

Do I Pay For Medicare Part A?

Medicare is a benefit that you pay into during your lifetime through taxes taken out of your paycheck. If you have worked for at least 10 years (40 quarters) and paid into the Medicare fund, you likely won’t have to pay for Part A once you qualify at retirement age or by way of legal disability. Homemakers or spouses who didn’t work can also qualify so long as their spouse worked for 10 years or more. Because you (or your spouse) have already paid into this fund, you don’t have to worry about paying a premium to receive Part A hospital coverage.

Sometimes, people have not worked the full 10 years to be eligible for Medicare. In this case, you would be required to pay a monthly premium to receive Part A coverage. For 2016, this premium can cost as much as $411 per month.

Is Part A Entirely Free?

Wouldn’t it be great to have all of your hospital costs covered with original Medicare?

It would — but unfortunately Medicare Part A does not work that way.

While you usually don’t have to pay a premium for Part A, there is still a deductible, $1,288 in 2016, and sometimes additional costs after a certain number of days if you stay in a hospital, rehabilitation center or nursing facility for an extended period of time.

Do I Need Other Forms of Insurance besides original Medicare?

Medicare Part A only covers hospital expenses, which means your coverage could be lacking.

If you feel that there are other medical services you need covered through insurance, private insurance companies offer options which can supplement or replace your Medicare coverage.

The Medicare Specialists at PolicyZip are available to help you compare your coverage options and find the optimal level of benefits at the most cost effective price.