Medicare Advantage (Part C) Enrollment

Understanding the differences between your Medicare options may be tricky, but it doesn’t have to be. If you understand the basics of what a Medicare Advantage Plan is, you’re well on your way to enrolling and selecting in a plan that best fits your healthcare needs.

What is a Medicare Advantage Plan?

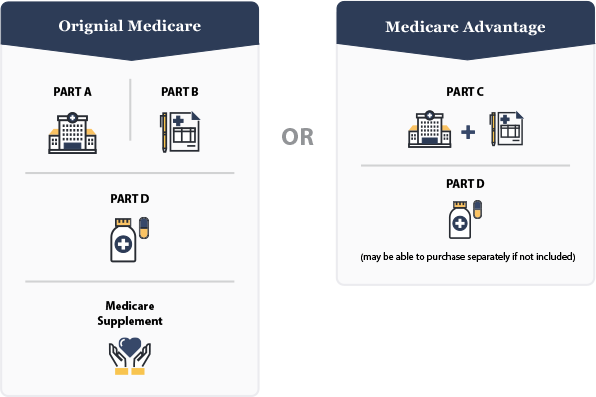

While Medicare Advantage may seem different than Original Medicare, it’s pretty similar. In fact, to enroll in Medicare Advantage, you must already have Medicare Part A (hospital coverage) and Part B (medical coverage). That’s because Medicare Advantage combines the benefits of both Part A and Part B, and often adds in Part D, which is prescription medication coverage. This combination is provided by a private insurance company, and may come with additional perks like vision, dental and hearing aid coverage (all things that Medicare does not offer).

If you enroll in a Medicare Advantage Plan, this means the private insurance company you select will provide your Medicare Plan A and Plan B benefits, along with other added benefits they choose to offer. By law, an insurance company cannot give you less coverage than you would have with an Original Medicare plan, but they can give you more options and help pay for more out-of-pocket costs. This way, you won’t have to worry about getting fewer benefits than if you stayed with Original Medicare.

You can always choose to stick with Part A and Part B, and add on Part D (prescription drug coverage) if Medicare Advantage doesn’t seem like the right option for you and, possibly, a Medicare Supplement as well to cover deductibles and coinsurance.

Who Can Enroll in Medicare Advantage?

You must be eligible for Medicare to enroll in a Medicare Advantage plan. If you’re not sure if you qualify for Medicare, consider these requirements:

1) You must be a United States citizen or permanent legal resident

2) You must have worked for at least 10 years or have a spouse who worked that length of time and paid taxes through your paycheck — this is how you contributed to the Social Security fund that covers many of your Medicare costs

3) If you have not paid into Social Security, you must have paid into Medicare payroll during your time of employment; this may be common for former government employees

4) You are age 65 or older

If you are not age 65, you may still qualify if:

- You have been receiving Social Security disability benefits for 24 months

- You receive a disability pension from the Railroad Retirement Board

- You have Lou Gehrig’s disease or renal failure that can only be treated through dialysis or a transplant

Meeting these qualifications means you are eligible for Medicare. There are a few additional restrictions you must consider when contemplating enrollment in a Medicare Advantage plan.

You Must Have Medicare Parts A and B

In order to enroll in a Medicare Advantage plan, you must be covered through Original Medicare Part A and Part B. Medicare Advantage combines your existing Part A and Part B insurance, often times adding Part D prescription coverage. It is important to understand that Medicare Advantage rolls all of the Medicare parts into one policy instead of replacing them, which is why you are still responsible for paying your Part B premium.

You Live in a Certain Area

Because Medicare Advantage plans are offered through private insurance companies, they can vary by region. Plans may offer different benefits or different levels of additional coverage for vision, hearing aids and dental work, amongst other benefits, based on where you live. This is because many Medicare Advantage plans use some kind of provider network, which helps insurance companies spend efficiently and save by using preferred doctors. While Medicare Advantage plans are essentially available nationwide, you can only join a plan that serves the area in which you live.

End-stage Renal Disease

A diagnosis of end-stage renal disease (ESRD) will disqualify you from signing up for a Medicare Advantage plan. People with permanent kidney failure that can only be treated through dialysis or a kidney transplant must generally stick with Original Medicare. The only exceptions to this rule are if:

- You have had a kidney transplant but still qualify for Medicare

- You already have health insurance benefits from an employer or spouse through the same insurance provider as the Medicare Advantage Plan

- You had a Medicare Advantage Plan before being diagnosed with end-stage renal disease

How to Enroll in a Medicare Advantage Plan

If you meet the eligibility requirements and determine that a Medicare Advantage plan is right for you, it is time to enroll. To find a plan, you can utilize the Medicare Plan Finder tool to locate insurance plans and coverage options in your area or work with an insurance agency like PolicyZip.

Note that when submitting your application for coverage, you need to provide your Medicare number. You will also be required to submit the dates your Original Medicare coverage began, so that the Medicare Advantage plan provider can determine your eligibility and finalize your coverage. This information is all located on your red, white and blue Medicare card.

You will also automatically qualify for the Silver Sneakers program.

When you switch to a Medicare Advantage plan, you will be automatically disenrolled from any existing plan. If you ever decided to switch back, you can call your Medicare Advantage Plan provider or contact Social Security.

When to Enroll in a Medicare Advantage Plan

Unfortunately, you cannot just enroll in a plan at any time. There are four times you’ll be able to sign up for a Medicare Advantage Plan:

1) During your Initial Enrollment Period (IEP), which begins three months before your 65th birthday and ends three months after. Understand that the sooner you sign up before your birthday month, the faster coverage will begin once you turn 65. Delaying your enrollment until after your birthday can delay your coverage start date and potentially lead to penalties in the form of higher premiums.

2) During Medicare General Enrollment, which begins January 1 and ends March 31. This time is common for people who have missed their Initial Enrollment Period.

3) During the Annual Election Period (AEP), also known as Fall Enrollment. This is from October 15 through December 7, and is a time to modify or adjust your coverage in any way necessary.

4) During Special Enrollment Periods. This is different for everyone, but generally opens for eight months when you leave a job that provided health insurance.

If you are confused about your window for enrollment, contact a Medicare Specialist at PolicyZip and we can help you determine when you are eligible to make coverage changes.