How Medicare Advantage (aka Medicare Part C) Works

Our customers tell us all the time that the alphabet soup called Medicare is confusing. Add on top of that trying to figure out how Medicare Advantage plans work, and it’s almost too much.

It’s safe to say that understanding Medicare Advantage plans is not as easy as falling off a log.

Our goal is to make this a bit easier for you.

This article should be very helpful!

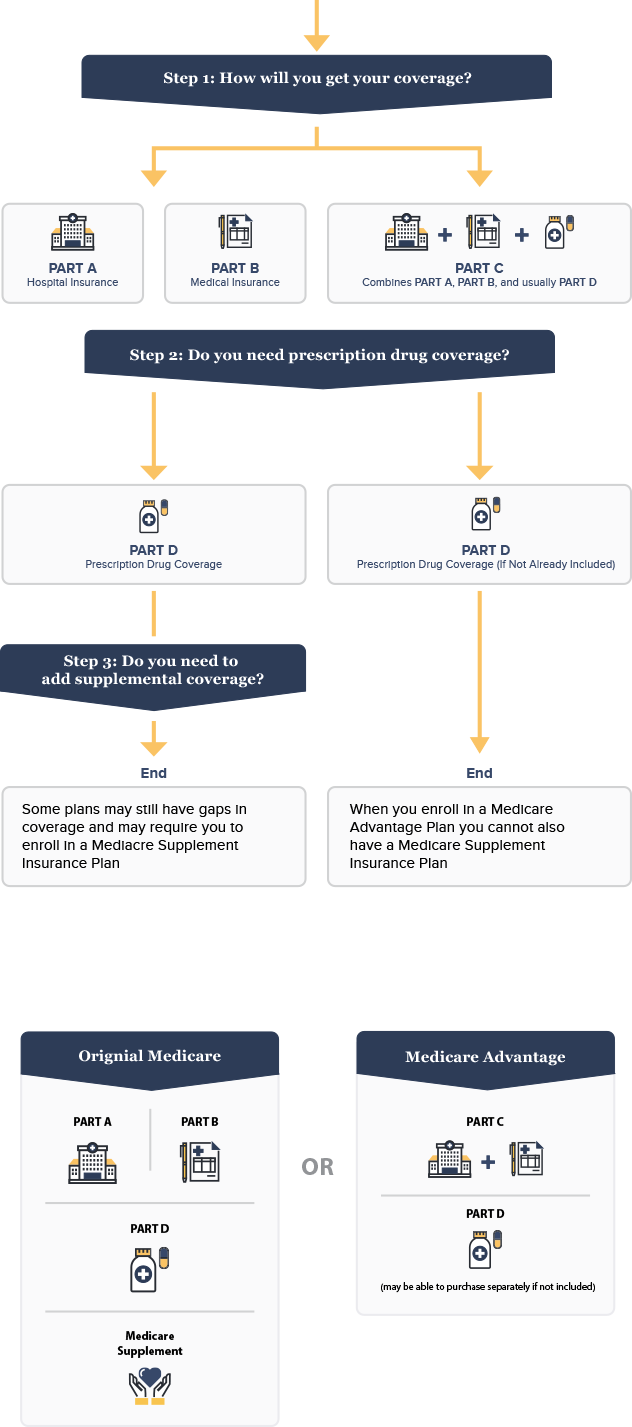

In order to understand how Medicare Advantage plans work, there are four types of Medicare you must understand, and we’ll get into them all:

- Medicare Part A: Hospital insurance which will have a deductible.

- Medicare Part B: Medical insurance and outpatient coverage which includes a 20% component that is your responsibility.

- Medicare Part C (Medicare Advantage): Utilizes private insurance companies to provide more targeted coverage.

- Medicare Part D: Drug coverage. Each plan is required to have a filed list of covered medications, also known as the drug formulary.

Enrollment data suggests the number of Medicare beneficiaries joining a Medicare Advantage plan vs. Medicare Supplement is increasing. Medicare Advantage enrollment continues to rise due to the cost savings provided.

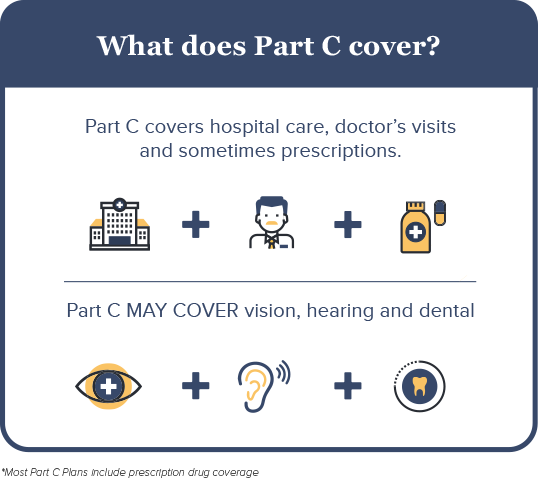

What are Medicare Part C plans and What Are the Covered Services?

Original Medicare consists of basic hospital coverage (Part A) and medical coverage (Part B). While Part A is standard and generally available at no cost if you 10 years of work history paying social security taxes, beneficiaries have the option to sign up for Part B, which has a modest monthly premium deducted each month from your social security.

Only once you have enrolled in original Medicare can you qualify for a Medicare Advantage plan.

Medicare Advantage, or Part C, is different from original Medicare because it replaces original Medicare Part A and B coverage as the primary insurance offered from private insurance companies approved by Medicare. These plans are commonly PPO or HMO.

Medicare opened the doors to more options by allowing private insurance companies to offer healthcare plans with additional benefits. There are many different kinds of Medicare Advantage plans with varying levels of coverage and allowed services, but they must provide the equivalent of both original Medicare Part A and Part B.

For example, joining a Medicare Advantage plan may provide you coverage for prescription medication, vision and dental needs, unlike original Medicare Part A and Medicare Part B.

Enrollment Requirements

Enrolling in a Medicare Advantage plan requires you to have Medicare Parts A and B per the enrollment rules. If you do not have both Parts A and B, you are not eligible for a Medicare Advantage plan.

The enrollment requirements are extremely strict. If you need help enrolling in Medicare, we suggest calling your local social security office to obtain your enrollment form.

If you need help enrolling in a Medicare advantage plan, you will need to speak with a licensed insurance agent.

How Do Medicare Advantage Plans Work?

Medicare Advantage, or Part C, combines multiple parts of original Medicare through one plan. In this sense, it’s not replacing original Medicare, but repackaging it into one plan which may come with additional benefits that private insurance companies choose to offer, but original Medicare may not.

Think about how Medicare Advantage plans work in this way: They look an awful lot like the health plans you probably had when you were working.

Every Medicare Advantage plan must offer the same basic coverage as original Medicare, so there is no need to worry you might receive fewer benefits if you choose to enroll in a Medicare Advantage plan.

This is important to repeat: Every Medicare Advantage plan must give you at a minimum coverage equal to that of original Medicare Part A and Part B. Some plans provide additional benefits such as vision, dental insurance, and fitness memberships amongst other items. These extra plans are sometimes why some people choose these types of plans.

Many people will try and scare you and tell you that enrolling in a Medicare Advantage takes away your original Medicare. That is NOT TRUE!

To qualify for Medicare Advantage, you MUST already have Medicare Part A and Part B. You will still be responsible for paying your Part B premium along with a Medicare Advantage premium.

How Do I Get a Medicare Advantage Plan?

Already on Medicare Advantage plan and renewing or switching

For most people, Medicare Part C enrollment dates happen during what is called the Annual or Open Enrollment Period (AEP). For 2018, AEP occurs from October 15th through December 7th. These are the only dates you can switch your Medicare Advantage plan for the upcoming plan year unless you meet a special enrollment period.

Current have a Medicare Supplement and switching to Medicare Advantage Plan

For those of you who are currently using a Medicare supplement, you will follow the guidelines of AEP which is from October 15th to December 7th should you decide to switch from a Medicare Supplement to a Medicare Advantage Plan.

Medicare Advantage plans are provided through private insurance companies and offer the same benefits as original Medicare, with some also offering prescription drug coverage and vision, dental or hearing care. If you’re wondering “when can I apply for Medicare Advantage?”, here is some Medicare Advantage info that will show your options:

Enrolling in a Medicare Advantage plan during your Initial Enrollment Period

When you first become eligible for Medicare, you have a seven-month Initial Enrollment Period (IEP) to sign up for a Medicare Advantage plan (also known as Medicare Part C).

If you are aging in to Medicare (aging in means you are turning 65), then your IEP begins three months before the month that you turn 65 and ends three months after the month you turn 65.

For example, if you age in to Medicare in May, then your Initial Enrollment Period begins February 1 and ends August 31.

Medicare Part C Enrollment Dates for Annual Enrollment Period (AEP)

The Medicare Part C enrollment dates for AEP is from October 15 to December 7, during which Medicare beneficiaries can apply for Medicare Advantage plan coverage. Beneficiaries can make the following changes to their coverage during this two-month period:

- Switch from original Medicare to Medicare Advantage

- Switch from a Medicare Advantage plan back to original Medicare

- Switch from a Medicare Advantage plan to a different Medicare Advantage plan in their service area

- Switch from a Medicare Advantage plan that doesn’t include drug coverage to one that does, and vice versa

Enrolling in a Medicare Advantage Plan During Special Enrollment Periods

If you missed the other enrollment periods, you generally have to wait for the Annual Election Period to come around again for enrolling in a Medicare Advantage plan. However, there are certain special circumstances that could qualify you for a Special Enrollment Period. Here is some Medicare Advantage info regarding how special circumstances can expand your options for enrolling in a Medicare Advantage plan:

- You moved out of your current plan’s service area.

- You are eligible for Medicaid.

- You qualify for the Extra Help program, which assists with the cost of your prescription medications.

- You are receiving care in an institution, such as a long-term care hospital or skilled nursing facility.

- You want to switch to a Medicare Advantage plan with a five-star overall quality rating.

Enrolling in a Medicare Advantage Plan is Easy

If you are enrolled in Medicare Part A and Part B and live in the Medicare Advantage plan’s service area, then you are eligible to join this plan during either your Initial Enrollment Period or the Annual Election Period, or during a Special Enrollment Period for which you qualify.

Not all Medicare Advantage plans will work the same way, so it is recommended that you compare all plans in your area to find the right one for your needs.

Taking the Next Steps

Consider when you can apply for Medicare Advantage. Mark your calendar or call a broker today!

For More Reading:

- Medicare Advantage vs. Medigap: Key Differences

- Why You Should Buy Medicare Supplement Insurance Right When You Turn 65

What are My Medicare Advantage Options?

Understanding Medicare Advantage plans and Medicare Advantage enrollment seems complex on the surface. However, these plans are similar to the types of health insurance plans many employers offer.

Private insurance companies can choose to offer some or all of the following types of health plans, with varying benefits. Here is an overview of the types of plans you will have to choose from:

- Health Maintenance Organization Plan (HMO). You can only go to health care providers or hospitals within the plan’s network. You must also have a referral from your primary doctor to see specialists or other doctors.

- Preferred Provider Organization Plan (PPO). You can go to doctors, hospitals and other providers outside of the plan’s network, but it is cheaper if you use physicians within the network.

- Private Fee-for-Service Plan (PFFS). You can go to any physician or hospital so long as that facility will take payments from the insurance plan.

- Special Needs Plan (SNP). This is for people with specific health care needs, such as those with chronic illnesses or individuals who live in nursing homes.

- HMO Point-of-Service Plan (HMO POS). Similar to an HMO, but it allows you to visit doctors and hospitals out of network. You will likely pay a higher copayment or coinsurance.

- Medical Savings Account Plan (MSA). This type of plan gives you a high deductible, but deposits money for you into a savings account. This money can be used to pay for health care costs throughout the year. With Medicare, these plans do not give you any prescription drug coverage, and you will need to sign up for Medicare Part D if you use medications.

How Much Does a Medicare Advantage Plan Cost?

Because Medicare Advantage Plans require you to already have original Medicare Part A and Part B, you’ll be responsible for paying your Part B premium. In addition, you may have a premium for your Medicare Advantage Plan, along with any copayments or coinsurance fees at the doctor’s office. Copayments and coinsurance vary by plan, so it’s important to understand your needs and budget when selecting a plan.

However, many Medicare Advantage plans have what is referred to a zero premium. This means there is no cost associated with these types of plans on a monthly basis. The only cost would be the associated copays and prescription drug costs.

PolicyZip can help you in understanding Medicare Advantage plans and coverage options. We encourage you to call us at (844) 205-7510 or fill out the form below to discuss your specific options.

Do I Need Medicare Part C?

Think of Medicare Part C as another option for your health care.

Unlike original Medicare Parts A, B and D, which are managed by the federal government, understanding Medicare Advantage plans starts with the face that Part C plans are managed by private insurance companies that meet federal guidelines to offer Medicare health care.

For some people, Medicare Part C will provide options and benefits they can’t get with original Medicare, such as:

- Lower cost. Medicare Advantage will allow you to mix and match services to meet your needs that could end up being less than original Medicare due to reducing your out of pocket costs and removing your exposure to Part A and Part B deductibles.

- Lower out-of-pocket costs. Fixed co-pay costs could be less expensive than the 20% liability and Medicare Advantage plans remove your liability of paying any Part A or Part B deductibles.

- Maximum out of pocket costs. Part C plans set a maximum amount of coverage to limit your financial exposure. If you only had Original Medicare, you would be liable for all your deductibles and 20% of all your medical and hospital related expenses.

- Flexibility on new services. Part C plans often offer additional benefits such as vision and dental, and sometimes offer wellness benefits such as Silver Sneakers.

Today, the latest enrollment statistics for Medicare show that almost 30% of Medicare-eligible people are enrolled in a Medicare Advantage (Part C) plan.

Medicare Part C Versus Medicare Part D

We receive a lot of questions regarding Medicare Part C versus Medicare Part D.

Medicare Part D is the prescription drug plan that is associated with original Medicare. Medicare Part A and Part B don’t provide prescription drug coverage in most situations, so Part D augments the coverage for original Medicare. Part D plans are provided by private insurance companies who meet the requirements of Medicare.

Medicare Part C, or Medicare Advantage as it is often referred to, provides a number of valuable options for both health coverage as well as prescription drug coverage. Most Medicare Advantage plans include a prescription drug option. Medicare Advantage plans are provided by private insurance companies who meet the requirements of Medicare.

If you are enrolled in a Medicare Advantage plan (Part C) that includes a prescription drug plan, you cannot be enrolled in a Part D plan.

Still confused on Medicare Part C versus Medicare Part D? Give us a call at NUMBER and we can walk you through it.

When is Medicare Advantage Open Enrollment?

In 2018, the Medicare Advantage enrollment period is October 15 through December 7.

When Does Medicare Advantage Enrollment End?

For most individuals who are either going through the enrollment process in Medicare or enrolling in a Medicare Advantage plan, the open enrollment period is October 15 through December 7.

Medicare health and prescription drug plans often change each year, so individuals should always review their plans. Typically, changes can be found in either the Evidence of Coverage (EOC) or the Annual Notice of Change (ANOC).

If your plan isn’t changing and your needs haven’t changed then there’s nothing you have to do.

Who is Eligible for Medicare Advantage Plans?

You must be eligible for Medicare to enroll in Medicare Advantage during one of the special enrollment periods. If you’re not sure if you qualify for Medicare, consider these requirements:

- You must be a United States citizen or permanent legal resident.

- You must have worked for at least 10 years or have a spouse who worked that length of time and paid taxes through your paycheck — this is how you contributed to the Social Security fund that covers many of your Medicare costs.

- If you have notpaid into Social Security, you must have paid into Medicare payroll during your time of employment; this may be common for former government employees.

- You are age 65 or older.

If you are not age 65, you may still qualify if:

- You have been receiving Social Security disability benefits for at least 24 months.

- You receive a disability pension from the Railroad Retirement Board.

- You have Lou Gehrig’s disease or renal failure that can only be treated through dialysis or a transplant.

Meeting these qualifications means you are eligible for Medicare. There are a few additional restrictions you must consider when contemplating enrollment in a Medicare Advantage plan:

You Must Have Medicare Parts A and B

In order to enroll in a Medicare Advantage plan, you must be covered through original Medicare Part A and Part B. Medicare Advantage provides the same level of services as Medicare Part A and Part B, and often provides additional benefits as well.

It is important to understand that Medicare Advantage rolls all of the Medicare parts into one policy instead of replacing them, which is why you are still responsible for paying your Part B premium.

You Live in a Certain Area

Because Medicare Advantage plans are offered through private insurance companies, they can vary by region. Plans may offer different benefits or different levels of additional coverage for vision, hearing aids, and dental work, amongst other benefits, based on where you live. This is because many Medicare Advantage plans use some kind of provider network, which helps insurance companies spend efficiently and save by using preferred doctors.

While Medicare Advantage plans are essentially available nationwide, you can only join a plan that serves the area in which you live.

You Have End-Stage Renal Disease

A diagnosis of end-stage renal disease (ESRD) will disqualify you from signing up for a Medicare Advantage plan. People with permanent kidney failure that can only be treated through dialysis or a kidney transplant must generally stick with original Medicare. The only exceptions to this rule are if:

- You have had a kidney transplant but still qualify for Medicare.

- You already have health insurance benefits from an employer or spouse through the same insurance provider as the Medicare Advantage plan.

- You had a Medicare Advantage plan before being diagnosed with end-stage renal disease.

Can Everyone Enroll in a Medicare Advantage Plan?

If you qualify for Medicare Part A and Part B, you likely can take advantage of Medicare Advantage enrollment periods. But, there are restrictions for some Medicare recipients. If you have end-stage renal disease (ESRD), you can’t sign up for a Medicare Advantage plan unless you were already using this kind of plan before developing ESRD, or you’ve had a successful kidney transplant but still have access to Medicare benefits.

Why Would I Want to Change my Medicare Advantage Plan?

No doubt that Medicare can be confusing, but the reasons to re-think your Medicare Advantage Part C coverage are the same as they were when you received health benefits through an employer:

- Your doctor is no longer in the Medicare network. Doctors come and go from health plans, so if your current plan no longer offers the doctor(s) that you want, you can evaluate other Medicare Advantage plans during the enrollment period.

- Important medications are no longer available on Medicare. When you receive your enrollment packet from Medicare, your Notice of Change letter will tell you if any of your medications are being dropped from coverage or if the price is going up.

- Your premium cost went up. We’re all on a budget, so if your costs go up significantly then open enrollment is your change to evaluate other options.

What is Difference Between Traditional Medicare and Medicare Advantage?

In simple terms, traditional Medicare (also called original Medicare) is a one-size-fits-all type of health coverage while Medicare Advantage comes with many options to get the coverage you need.

For the most part, individuals qualify for Medicare when they turn 65. Medicare also covers individuals younger than 65 with qualifying disabilities.

Medicare has four components, some are mandatory while others are optional.

Part A: Hospital Coverage

Part A is what most people call the health care option of original Medicare. It covers the costs of being in hospitals or other medical facilities. Part A is what you automatically receive when you enroll in Medicare and, for most individuals, there is no cost.

Services covered under Part A include tests, surgeries, doctor visits, home healthcare inpatient care in hospitals and skilled nursing facilities, hospice care, home healthcare services and inpatient care in a religious nonmedical healthcare institution – a facility that provides medical services that align with certain religious beliefs.

Part B: Doctors, Tests and Other Procedures

Part B covers many procedures and services: doctor’s services, medical equipment, ambulance, outpatient care and procedures, home healthcare, blood, cancer treatments and many more. Individuals must enroll in Part B if they aren’t covered by another insurance plan.

Part B has a monthly premium, and once you meet your deductible, you are responsible for 20% of the Medicare-approved cost of the service. Be sure to check that your provider accepts Medicare assignment.

Part C: How Medicare Advantage Plans Work

Here’s how Medicare Advantage Plans work.

Joining a Medicare Advantage plan provides individuals more options than original Medicare.

The coverage typically includes all of Parts A and B as well as a drug plan and, often, other benefits like vision and dental coverage. Part C plans are administered by private insurance companies and can sometimes be less expensive than if you pay for Parts A, B and D separately.

Part D: Prescription Drugs

Part D is required unless you have a prescription drug plan from another source (commonly referred to as “credible coverage”), including a Medicare Advantage plan. Your plan may include a deductible, depending on your coverage.

Medicare Part C vs. Medicare Part D

This is a very common misconception. Comparing Medicare Part C vs Medicare Part D is like comparing apples to oranges, but they are related.

Medicare Part D covers your prescription drugs and the only way to satisfy the Medicare Part D requirement is to either purchase a stand alone Part D plan or enroll in a Medicare Advantage plan that offers part D coverage, also known as an MAPD.

regardless of how you get your Part D, you need to make sure you are aware of the late enrollment penalties that can be charged. The late enrollment penality is a penalty applied when you do not enroll in a Medicare Part D plan upon becoming eligible for traditional Medicare. One way many people avoid late enrollment penalty is by having credible drug coverage such as an employer plan.

If you do not have credible drug coverage at the time you complete your enrollment form, you may be subject to a late enrollment penalty.

Medicare Advantage vs. Traditional Medicare

In the simplest terms, Medicare Advantage provides you the same options as original Medicare with the addition of embedded cost control protection via copays and deductibles.

By law Medicare Advantage companies must provide the same benefits as original Medicare.

Medicare Advantage in most cases will save you money.

The test is what are your needs? If you are looking for coverage that includes a wide range of services beyond basic health care, such as vision and dental, then Medicare Advantage could be a good option. However, if your needs are basic, original Medicare may be for you.

When Can You Sign Up for Medicare Advantage plans?

Unfortunately, you cannot just enroll in a plan at any time. Joining a Medicare Advantage plan can happen during one of following four special enrollment periods:

- During your Initial Enrollment Period (IEP). This time period begins three months before your 65th birthday and ends three months after. Understand that the sooner you sign up before your birthday month, the faster coverage will begin once you turn 65. Delaying your enrollment until after your birthday can delay your coverage start date and potentially lead to penalties in the form of higher premiums.

- During Medicare General Enrollment. This begins January 1 and ends March 31. This time is for people who missed their Initial Enrollment Period.

- During the Annual Election Period (AEP). Also known as Fall Enrollment, this is from October 15 through December 7, and is a time to modify or adjust your coverage in any way necessary.

- During Special Enrollment Periods. This is different for everyone, but generally opens for eight months when you leave a job that provided health insurance.

What is Medicare Supplement Insurance?

Medicare Supplement insurance, also known as Medigap coverage, helps cover costs not paid under original Medicare, such as copayments and deductibles. Medicare Supplement coverage cannot be used with Medicare Advantage.

Medicare Supplement insurance is sold by private insurance companies.

Here are four important points about Medicare Supplement insurance:

- Coverage is only for one person. If there are two Medicare-eligible people in the household and both want supplemental coverage for their original Medicare coverage, they will have to each have a Medicare Supplement policy.

- Medicare Part A and Part B are required. Since Medicare Supplements were designed to offset the out-of-pocket costs of original Medicare, this type of coverage requires you to have both Parts A and B.

- Purchase from an approved agent. Medicare Supplement coverage is sold by licensed private insurance companies and agents.

- No cancellation as long as premiums are paid. Even if you become ill while you have Medicare Supplement coverage, it cannot be taken away as long as you pay the monthly premiums.

How Do I Choose Medicare Supplemental Insurance?

True to its name, Medicare Supplement insurance is designed to help offset the costs of original Medicare.

So, if original Medicare is the right type of coverage for you versus Medicare Advantage (Part C), then find an insurance company like PolicyZip to help you evaluate the many options.

We wrote a highly detailed article regarding choosing and changing your medicare supplement. You can read it here.

Late Enrollment and How It Could Affect You

To avoid the late enrollment penalty, it’s important for individuals nearing their 65th birthday to go through the enrollment process to avoid a potential late enrollment penalty. Joining a Medicare Advantage plan that offers part D coverage at the time you are eligibile for Medicare will avoid the Medicare late enrollment penalty.

Joining a Medicare Advantage plan after you are eligible for Medicare and not having credible coverage will not avoid the late enrollment penalty. You’ll need to include your effective date on your enrollment form and if you don’t have one, then you may be subjected to the penalty.

Following is an overview of how a late enrollment penalty could be assessed (and a link at the end of this section to the Medicare website for more details):

- Part A. If you are not eligible for premium-free Medicare Part A and you don’t sign up for it when you are first eligible, you could be subject a penalty of up to 10% of the monthly premium. There are additional stipulations on the late enrollment penalty based on how late you enroll.

- Part B. If you are not automatically enrolled into Part B and you don’t enroll when you are first eligible you could be subject to a late enrollment penalty of up to 10%, which is added to the monthly Part B premium. There are additional stipulations on the late enrollment penalty based on how late you enroll.

- Part D. If you don’t enroll in a Part D prescription plan or a Medicare Advantage Plan which has a prescription drug plan during the initial enrollment period for Part D, you may have to pay a late enrollment penalty. There are stipulations to avoid this penalty that can be found on the Medicare website link below.

The following link gets you to more detailed information at the Medicare website: https://www.ehealthmedicare.com/apply-for-medicare/when/late-enrollment-penalties/

Important Medicare Forms

The Medicare website provides access to all Medicare-related forms at https://www.medicare.gov/forms-help-and-resources/forms/medicare-forms.html.

The site provides forms for enrollment as well as appeals and other important aspects, such as how to deal with your personal health information and who has access to it.